In 2021 married filing separately taxpayers only receive a standard deduction of 12550 compared to the 25100 offered to those who filed jointly. You cannot just go back on the same Form 1040 and change it to married filing separately.

Married Filing Separately When Does It Make Sense Benzinga

When you file separately your refund and your spouses refund are processed separately.

. In order to decide what is the right choice for you as a. If your spouses refund is subject to seizure but yours is not you can protect it by filing separately. An explanation of separate and joint tax filing is given below.

You earn more credits and deductions. To file jointly means you file a single return which will include the income and deductions for both spouses. See IRS Pub 17 for the full list.

When filing jointly you and your spouse must combine incomes and benefits to determine the taxable portion. In 2019 the standard deduction for a married pair filing jointly is 24400. Married filing jointly MFJ.

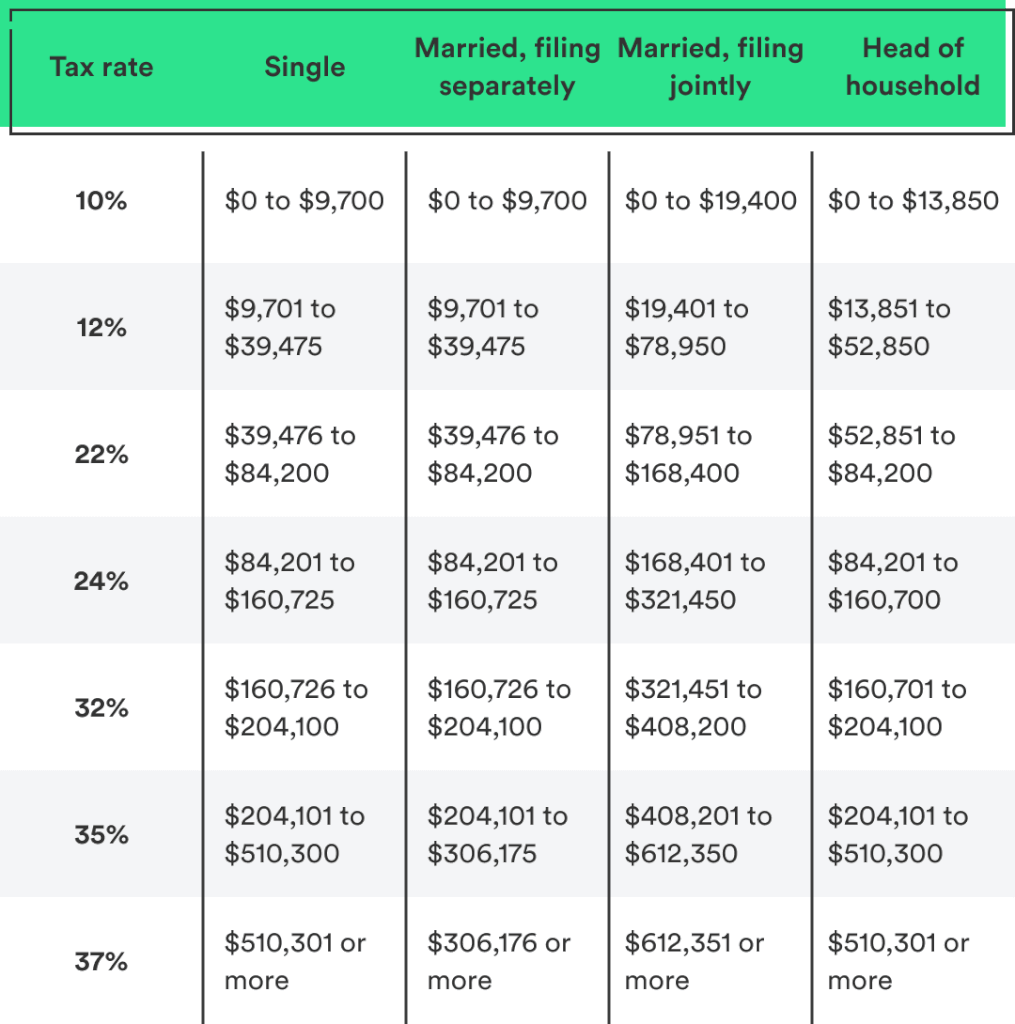

This is especially noteworthy for a married couple where one spouse has a six-figure income and the other spouse has a much lower income. Taxpayers can file their federal income tax returns as married filing jointly married filing separately head of household single or qualifying widow er. Your standard deduction might also be higher and you may qualify for other tax credits and deductions that are not available when married filing separately.

Generally more of your Social Security benefits are taxable when you file separately. Married taxpayers usually file their returns jointly since that is what makes the most sense for the majority of couples. If you want to file separate returns you have to prepare TWO tax returns---one for each spouse.

The standard deduction for separate filers is far lower than that offered to joint filers. Conversely for those filing separately the tax break is just 12200 which is. Married filing separately vs jointly is a choice that you and your spouse can make.

Married Filing Jointly vs Married Filing Separately. If you file separately and take itemized deductions instead of the standard deduction then both spouses have to itemize. He makes significantly more money than I do almost 4 times as much but I have investments worth about what he makes in a year.

Filing jointly gives a bigger tax due. Separate returns however limit your income tax liability to the tax and penalties from your own return not your. Married filing Jointly is usually the better way to file.

This is why most married couples file jointly. Married filing separately MFS. If youre married youre only eligible for certain tax breaks if you file a joint return.

The benefits gotten by married couples who have filed jointly for Child Tax Credit Personal exemptions and itemized deductions are cut in to half. Married Filing Jointly vs Married Filing Seperate. Your income tax credits and deductions are calculated separately from those of your spouse.

If you file MFS Married Filing Separately keep in mind that there are several limitations to MFS. However even when you file separately you must still report your spouses information on your return. Separate tax returns may give you a higher tax with a higher tax rate.

In general a joint return results in lower overall tax and provides tax benefits not available to other filing statuses. Those filing separately will report their individual income and deductions on separate returns. Each person files their own return keeping incomes and deductions separate.

Compared to joint filers separate filers have a much lower standard deduction. Most taxpayers who have a dependent living with them and single can file their taxes as a head of household. The taxpayers who are married on the other hand can file their federal.

The standard deduction is zero for the non. The income thresholds that apply to each tax bracket are lower for married individuals who file separately than for joint filers. However there are some unique situations when it would be better to file separately and get a bigger tax refund than you would if filing jointly.

I am getting married and I was wondering how this will affect my taxes. It is possible for some separate tax returns to get higher taxes as well as a higher tax rate. When you file jointly both spouses are liable for the tax due.

What is the difference between filing jointly and separately. Married filing jointly typically results in lower taxes due to the IRS. If you are married in general there are only two filing status options for you married filing joint MFJ or married filing separate MFS.

In case both you plus your spouse earn an income and you file jointly your current medical expenses will have to be higher in order to be able to create any. Filing separately brings higher taxes and benefits such as Education benefits Adoption credit Earned income credit Child and Dependent Care Credit cannot be claimed. In some cases that well discuss below you may be considered unmarried even if you are not legally separated under a decree of divorce or separate maintenance.

Filing separate tax returns means filing similar paperwork that you would as a single person. When you file as Married Filing Jointly you are both responsible for all income and deductions on the tax return even if only one spouse earned all the income. You can also file as married filing separately if you are married on the last day of the year.

Married couples have the option to file a joint tax return or separate tax returns. When you file separately you lose out on many deductions and credits that those who file joint returns will receive. Couples who file separately lose the opportunity to.

For instance in 2021 married couples that filed separately only got a 12550 standard deduction whereas joint filers had a 25100 one. This is an alternative to filing jointly. Will this affect how much we owe together.

A few of those limitations are.

Married Filing Separately Disadvantages H R Block

0 Comments